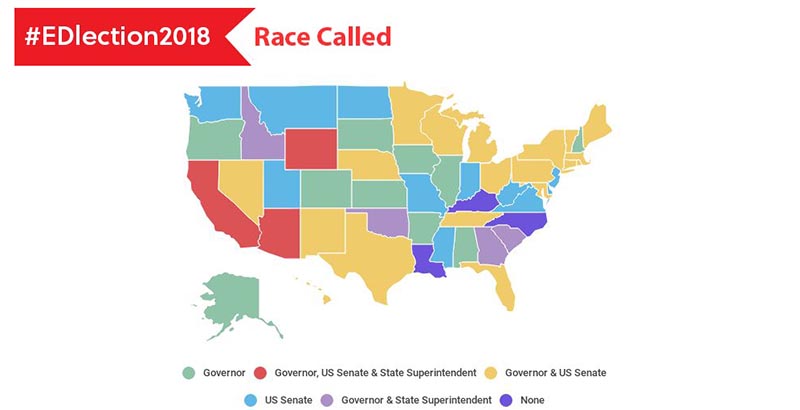

The tax revenue collected from the gross casino revenue tax is split among seven (7) funds benefiting the counties and certain large cities, school districts, host cities, the Casino Control Commission, the Ohio State Racing Commission, law enforcement training, and problem gambling and addictions. New Jersey Gambling Revenue: Where Does All the Money Go? Claire Levy Updated on June 27. The Casino Revenue Fund is managed by the Casino Control Commission, which in turn, falls under the jurisdiction of the Division of Gaming Enforcement. The tax money raised from gambling in New Jersey is used to help support government programs. Casino revenue is estimated as of 1998. Not all people living in Indian Reservations are tribal members and not all tribal members live on their reservations. Calculations use a simple average, that is, the sum of variables in each county divided by the total number of counties.

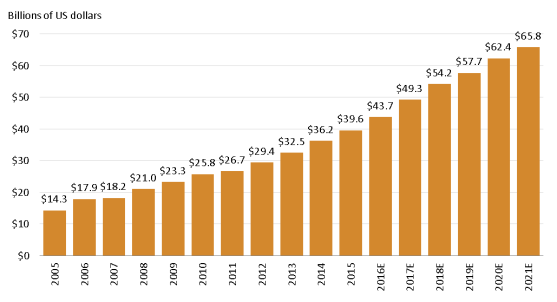

Casino Revenue Data

Dear Editor in Chief

A recent study showed that budgeting system in Iran based on incremental method and relies on inventory of the National Treasury’s (1). In fact, most experts believe that budgeting in Iran is faced with several complications (2, 3). Studies (49) confirmed that traditional methods of budgeting have been ineffectiveness and inapplicable. It is worth noting that traditional methods of budgeting do not meet requirements of managers and decision-makers. Hence, reforming the budgeting system and implementation of performance-based budgeting system as a necessity has been mentioned in the fourth economic, social and cultural development Plan Act of the Islamic Republic of Iran (articles 138 and 144). This has been emphasized in the general policies of the fifth economic, social and cultural development Plan Act of the Islamic Republic of Iran (point’s 32 and article 219) (3).

Nowadays there are at least four alternatives to traditional methods of budgeting as following: a) planning programming budgeting system (PPBS), b) zero-based budgeting, c) Incremental budgeting and d) performance-based budgeting. Performance-based budgeting has the advantage of being flexible for needs of decision-makers than most other methods and is much popularity in Iran (3). Therefore, financial management reforms launched to the Ministry of Health and Medical Education (MOHME) as a “new financial system” in recent years and have been suggested in four steps following:

Accounting approach change from cash-based to accrual-based

Establishment of cost price system

Implementation of performance-based budgeting

Productivity management, evidence-based analyzing and decision making

The first step was started from 2005 and it has been currently developed up in the affiliated units of MOHME. It is remarkable that the MOHME are preparing the basic infrastructure to appropriate implementation of performance-based budgeting. Encoding of cost centers and identifying the revenue and cost behavior are requirements to establishment of performance-based budgeting in the health system. Thus, cost price of services will be calculated and even MOHME can forecast of cost price. Also, elasticity of revenue and cost of services should be examined and analyzed. After the implementing performance-based budgeting, MOHME can expect that tariffs are actually and funding of government insurances is obtained from the public sources. Resource integration of insurances, as well as other policies can help to easier implementing of performance-based budgeting in the health system.

Acknowledgements

The authors declare that there is no conflict of interests.

Casino Revenue By State

References

- Abolhallaje M (2014) Dsigning a comprehensive financial management system for Iran.Iran University of Medical Sciences. [Google Scholar]

- Ghasemi M (2005). The President and the Problem of Budgeting in Iran. Parliamentary and Research, 11: 92–113. [Google Scholar]

- Mahdavi G, Golmohammadi M (2012). An Investigation into the Level of Familiarity of Chief Financial Officers with New Methods of Budgeting in Fars Province Authorities. Health Account, 1: 85–110. [Google Scholar]

- Frow N, Marginson D, Ogden S (2010). “Continuous” budgeting: Reconciling budget flexibility with budgetary control. Account Org Soc, 35: 444–461. [Google Scholar]

- Andrews M, Hill H (2003). The Impact of Traditional Budgeting Systems on the Effectiveness of Performance-Based Budgeting: A Different Viewpoint on Recent Findings. Int J Public Admin, 26: 135–155. [Google Scholar]

- Brander Brown J, Atkinson H (2001). Budgeting in the information age: a fresh approach. Int J Contemp Hosp Manage, 13: 136–143. [Google Scholar]

- Horváth P, Ralf S (2004). Why budgeting fails: one management system is not enough. ed. Harvard Business School Publishing. [Google Scholar]

- Rickards RC (2006). Beyond budgeting: boon or boondoggle. Invest Manage Financ Innov, 3: 62–76. [Google Scholar]

- Daum JH (2002). Beyond Budgeting: A Model for Performance Management and Controlling in the 21st Century?Control Financ, 5: 33–34. [Google Scholar]